Most small businesses accept credit and debit cards. Online businesses usually work through PayPal, Stripe, Google, or Apple Pay. These are very popular options.

However, there are other ways to get paid that are faster, more flexible, with fewer fees and regulations, and work internationally.

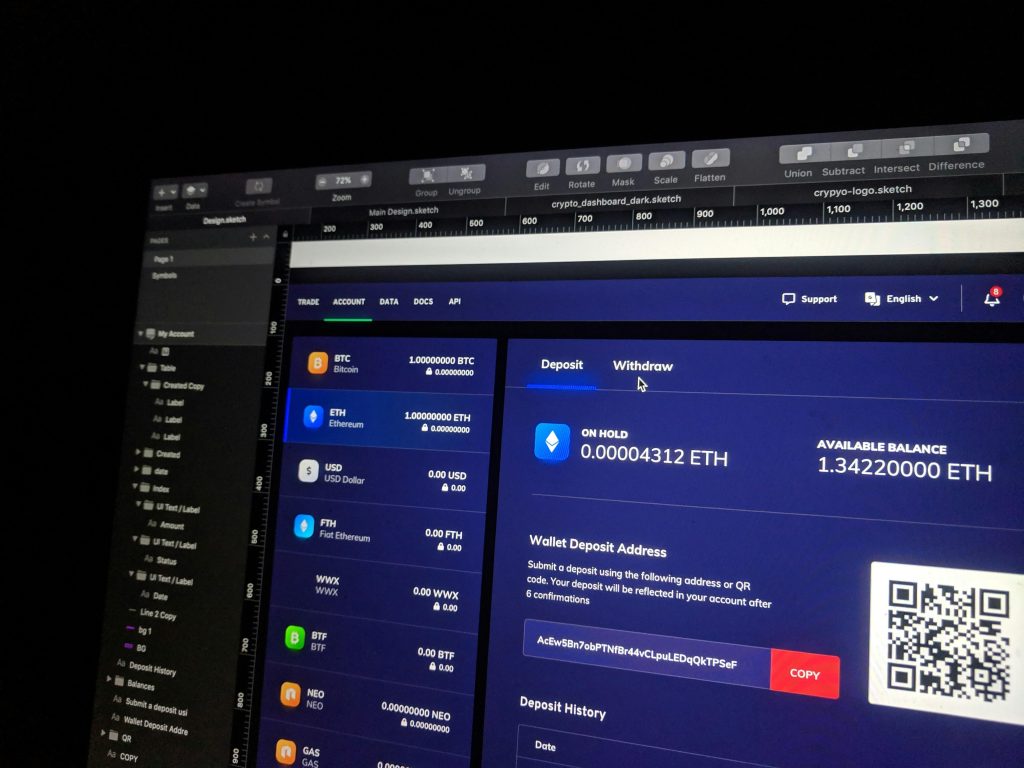

I’m going to look at accepting Bitcoin and other cryptocurrencies. The question is, how do they help you, and should you accept them in your small business?

Bitcoin and Cryptocurrencies

Bitcoin is the original cryptocurrency. It’s been around since 2008 and was selling at a dollar. Just this week it traded at a high of more than $72,000 a coin.

This is just one reason you should consider accepting it. With the price of cryptos rising again, they’re getting more popular, and these adopters will want to use them to buy goods and services. It is estimated that there are 420 million crypto users globally and growing.

In the near term, people will expect it as a payment option. It opens your business to new international customers without high exchange fees and a fast settlement.

Investors like them because, while they’re not totally anonymous, individual transactions are not tied to a specific person. Cryptos have few regulations and can be transferred directly from the payer to the payee, between countries, and outside of the banking system.

One negative is that cryptos are volatile, and their prices change, sometimes significantly. If you hold them instead of converting them into fiat dollars, they can lose or gain value. This can either work for or against you.

Cryptos offer an advantage for a business owner. There are lower fees than credit card transactions, Paypal, Apple Pay, and others, ranging from 1.9 to 3.5% of the transaction value. Cryptos aren’t reversible, so there are no chargebacks. The transactions are faster since they go from computer to computer, and no central authority oversees your transaction.

How to accept cryptocurrencies

There are several ways to accept cryptos, but first, you must decide the following:

First, do you want to keep the crypto or immediately convert it into fiat.

Second, which coins will you accept. There are more than 100 coins, but some are more popular and liquid than others.

Third, do you understand how they work? Do you need to use a payment gateway, which may reduce the benefits of the coins, or can you use a wallet and do it yourself?

1- Your crypto wallet.

This is the fastest and cheapest way to take them. However, it does require some knowledge of how it works. You provide your wallet address or QRC code, bill your customers, and they pay you with their coins. You must make sure the transaction occurred, and the coins were received. In the case of a refund, you need to issue it in a secure manner so no one sees your wallet and gets access.

2- A crypto plugin.

You can add a plugin or app to your website, and it will handle the technicalities for you. There are several options, so research to see how they work.

Are there hidden charges? Does it automatically convert the cryptos into fiat? Does the plugin redirect you to a third-party website to complete the transaction? You need to decide which features you want or don’t want.

There are several options with different features.

Cryptoniq works with WordPress, and the payment goes directly to the merchant’s wallet. There are no withdrawal fees. Other plugins to research are MyCryptoCheckout, GoURL, NowPayments, and MoonPay.

Here is a review of different plugins that work with WordPress.

3-A Crypto Payment Gateway

A payment gateway is a third-party processor. It removes the control that cryptos are designed to bypass. Also, it can freeze your funds in certain situations. For these reasons, it is my least favorite choice.

However, if you don’t understand cryptos or don’t want to hold them, these processes convert the coins to fiat and transfer the money to your bank account. Most of them charge a fee, usually 1%.

Here are a few well-known gateways: Coinbase Commerce, Bitpay, and Crypto.com.

Coinbase Commerce. Coinbase is one of the largest crypto exchanges. Coinbase Commerce is a digital payment service. It allows you to accept payments in seven different coins and which are received directly intro your wallet. There are no transaction fees for commerce accounts.

Bitpay is a currency debit card that allows the buyer to use the coins to make payments within the Mastercard’s network.

Crypto.com is a payment option for your customers to purchase with their desired cryptocurrencies, seamlessly and securely. But is only works with some ecommerce platforms.

Conclusion

Cryptos are becoming more popular, and you should include them as an option, as consumers will want to use them.

In addition, there is another payment option, which we won’t discuss in detail here. It is the QR Code, also known as scan to pay. It will also become a more popular payment option shortly.

Don’t limit your ability to get paid based on what is currently popular. There are many new possibilities.

A Special Offer

My e-course, The Idea Finder Course. is now available for free. There are 10 lessons about finding your passion, your ideal life, and the right niche to start your business. Instead of working for someone, learn to provide for yourself and not depend on a job.

Freedom and Independence have always been important to me, and I want you to have them. One way is to get control of your income, and wealth, and determine how you live your life.

It’s now FREE with no strings attached.

The Solo Entrepreneur’s Guide

To make sure you get access to our monthly newsletter, subscribe to The Solo Entrepreneur’s Guide.

The valuable content in that publication will help you transition from the job world and create a self-reliant income, live life your way, and achieve wealth, freedom, and independence.

Leave a Reply